Chime Bank Direct Deposit Time

- The latest a bank is required to make any routine direct deposit (not just SSI) available is when it opens the morning of your payday; I worked in a payroll office for 9 years so I knew that in case anyone.

- With the early direct deposit feature, your direct deposit will be posted to your Chime Spending Account as soon as it is received from your employer or payer. If you have questions about the timing of your.

So I recently created a chime account, and a week ago I gave my employer my direct deposit slip, it’s been a week and nothings happened? And in the chime app on my account it says that I haven’t set up direct deposit. In this video I show you how to chime bank direct deposit works and give you tips on using the chime app!💪Subscribe to Brandon Young- https://goo.gl/Wd56du.

Are your Direct Deposits taking much time? Switch to Chime!

Chime virtual bank ensures instant transfers. It sends a word whenever a direct deposit arrives.

The Chime Direct Deposits also have a limit.

Direct Deposits allow you to deposit funds directly to the bank account, but these deposits are sometimes delayed due to holidays or weekends. Nevertheless, Chime always has an answer to every question. The blog will give a piece of detailed information about Chime Direct Deposits. It will also help you know about Chime Direct Deposits limits.

Let us begin!

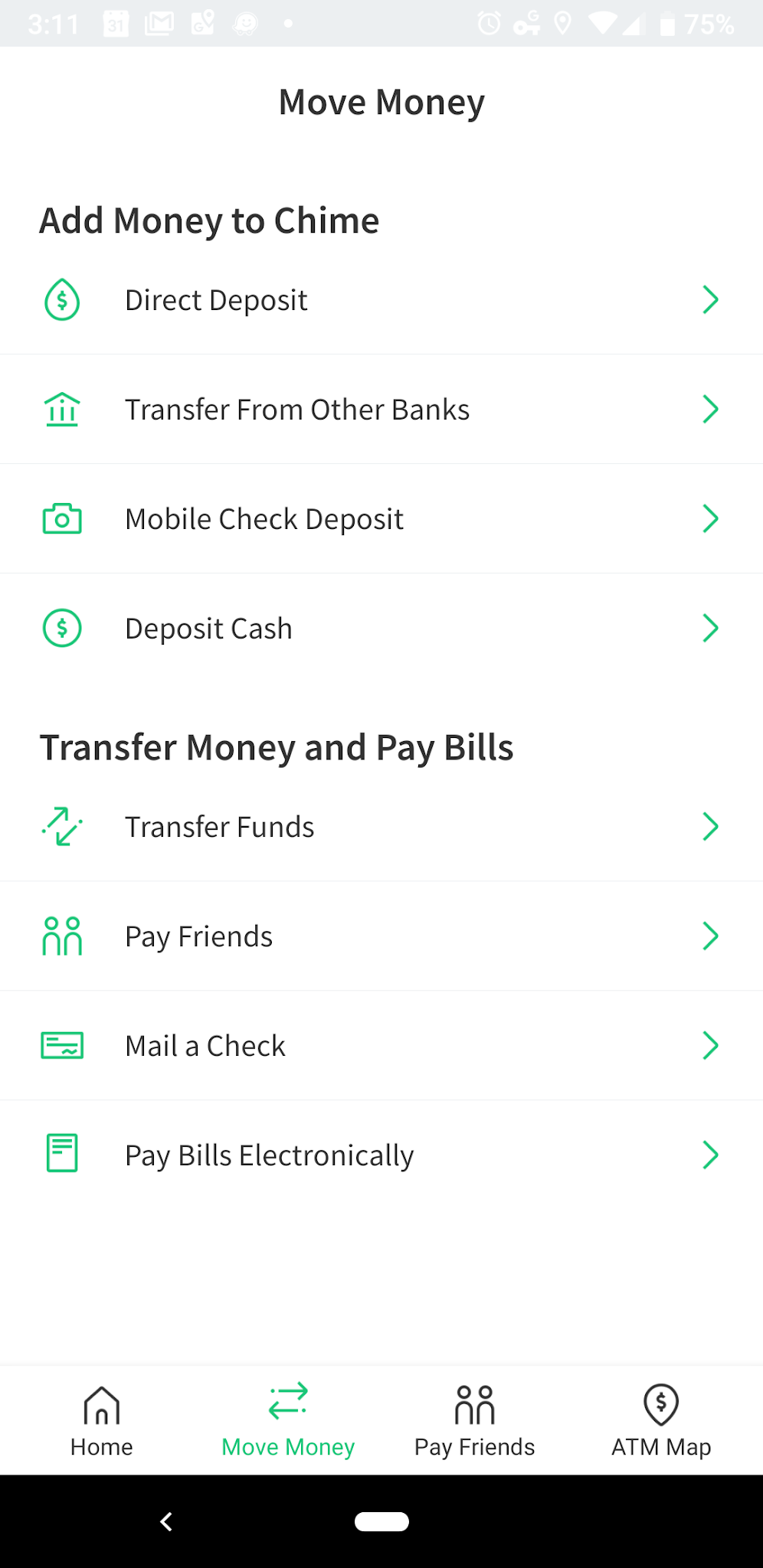

Now, let us learn how to begin working with Chime Direct Deposits.

Sign up for Direct Deposits

The first step to begin with direct deposits is to sign up to Chime. However, if you have an account, just log in and start with the process. To sign up to Chime, you need your name, Social Security Number(SSN), and Email. Now you can share your Account number and the routing number present in the Move Money Tab with the employer. Your account is all set to receive direct deposits. You can also hold your deposits by providing Chime’s FDIC Insured Partner banks.

Working

Chime Direct Deposit works just like any other bank’s Direct Deposits. Before reaching your bank, the Direct Deposits pass through a series of processing. The process has to be done as it is a compulsory procedure. Chime has no right to interfere in the process. Hence, Chime notifies you only when the direct deposits reach the bank after completing the process.

Time taken by Direct Deposits

The time taken by Direct Deposits depends entirely on the processing period. Chime informs you at the same moment when it receives the deposit.

Chime allows a maximum of three deposits per day. The direct deposit limit is $1000 per day and $10,000 per month. Deposits are also made through third-party sources. If you use a third-party money transfer to add funds to your account, they will impose their terms and conditions. You cannot violate their limitations and have to pay the fees charged by them.

Deposits tend to set back due to the holidays observed by the Chime Bank. The Chime Bank is non-working during federal and bank holidays. These include New Year’s Day, Independence Day, Labor Day, and so on. The complete list of Chime’s holidays can be found on the Chime official website.

Chime Direct Deposits quickens your payments and help you save a lot of time. You can also avail Chime Spotme Services by keeping a regularity in Direct deposits. Chime Direct Deposits also give you the advantage of receiving your payments two days earlier than other banks.

However, these deposits also have a limit. The Chime Direct Deposit limits cannot be tampered with. But, you should maintain a better account history to avail the extra benefits. Chime keeps an eye on your transactions and rewards you from time to time to encourage continuous working on the account. Chime Direct Deposits are faster than other banks, but they too are affected by federal and bank holidays. Still, Chime is always at the topmost position among other neobanks.

A popular way to receive your paycheck today is by direct deposit.

With direct deposit, you don’t have to take a physical check to a brick-and-mortar bank. You don’t even have to take a picture of the check to deposit it via your smartphone into your bank account. Instead, you can cut out these extra steps and have your money directly deposited into your bank account on payday with no hidden fees.

Direct deposit is basically an electronic payment from one bank to another. The best part is that most employers offer direct deposit as a payment option and it’s simple to set up.

Read on to become more familiar with how direct deposit works.

When you are set up for direct deposit with your employer, the funds for your pay will simply be transferred from your employer’s bank account to your bank account. To transfer the funds, banks use the Automated Clearing House (ACH) network to coordinate these payments among financial institutions.

You’ll still have access to your paycheck stub so that you can review your timesheet, see the amount of taxes taken out, view your vacation time, and so on.

Direct deposit is not just limited to your paycheck. You can set up direct deposit for your tax refund, social security or disability income, and other types of payments that you may receive.

When you start a new job, your employer may ask you if you want to set up direct deposit, or you can simply ask how to start this easy process.

If direct deposit sounds like something you’d be interested in, here are some key steps you’ll need to follow in order to get everything set up. Remember, most employers and even many government agencies offer direct deposit so this is a totally secure and convenient way to get paid.

1. Get a direct deposit form from your employer

Start by asking your employer for a direct deposit form. This is a crucial step since you can’t continue without this. The direct deposit form is a document that authorizes your employer to send money to your bank account using an ABA routing number and a bank account number.

2. Provide your personal bank account information

To complete the form, you will need to add information like:

- Your bank account name and address

- Bank account number

- Routing number

- Type of account (checking or savings)

- Name(s) of the account holder

You can find most of this information on a voided check, your bank account statement, or via your mobile bank account app.

4. Decide how much money you want to be deposited into your bank account

Next, be sure to determine how much money you want to be deposited into your bank account.

While some people opt to have their entire paycheck deposited into their checking account, a cool feature with direct deposit is that you can split up the payment between your checking and savings accounts.

For example, you may want your employer to deposit 10% of your income to your savings account and the remaining 90% into your checking account.

Chime’s automatic savings feature, for example, makes it easy for you to do this so you don’t have to think about saving money. This way you can set aside a portion of your income automatically and budget the rest of your paycheck for other expenses.

Another option you may want to consider is splitting up your direct deposit amount between your checking account and your partner’s checking account. If you combine expenses with your spouse or live on one income, this may be a convenient way to disperse your paycheck.

5. Include a voided check or deposit slip with your direct deposit form

You may also be asked to provide a voided check when you turn in your direct deposit form. A voided check is a check that has the word ‘VOID’ written across the front. This indicates that the check can’t be accepted for payment, but can be used to gather important bank account details and information.

And, even though you’re already providing this information on the direct deposit form, it’s still a great idea to verify everything with a voided check to ensure that your paycheck gets deposited into the correct account.

6. Submit your direct deposit form to your employer & monitor your bank account

Check to make sure that the information on your direct deposit form is accurate before you turn it in. Your employer or the HR department should let you know how long it will take to process your information and set up your direct deposit.

You may have to wait one or two pay periods, but keep your eye on your bank account around payday so you’ll know when the direct deposit kicks in.

Wondering how you can find your Chime Routing Number? 👀

If you’re still wondering whether you should sign up for direct deposit at your job, here are some key benefits you should consider when you make the switch.

- You’ll save time: Having direct deposit means your money goes directly into your account. This means you don’t have to spend time going to a bank or check cashing service after work to cash your check.

- You’ll save money: Sometimes, if you don’t cash a check at your traditional bank, you’ll get charged a fee. Currency exchanges often charge fees that increase with the amount of your check. And, some big banks may not cash your check if you don’t have an account there, or they may even charge you a fee. Direct deposit makes it easy to avoid these unnecessary charges and get your paycheck delivered directly to your account.

- You can get paid early¹: Another great benefit you should consider is the fact that you can actually get paid earlier. Chime’s Get Paid Early feature allows you to get your paycheck up to 2 days earlier¹ with direct deposit.

Setting up direct deposit is easy, free, and will likely be a more convenient way for you to get paid.

Don’t procrastinate because this can end up costing you more money and time in the long-run. Instead, take action today and improve your financial future.

What Time Does Chime Bank Direct Deposit Hit

Already banking through Chime? Learn how to set up direct deposit with Chime.