Bank Of Baroda Fixed Deposit Interest Rate

BOB Deposits – Great Rates, Convenient and Flexible

Fixed deposit accounts are an excellent means to grow your money over a period of time. Interest rates on fixed deposit schemes are generally higher than the interest on savings accounts. If you invest in fixed deposits, you can get higher returns for the same amount of money in a savings account in the same period of time.

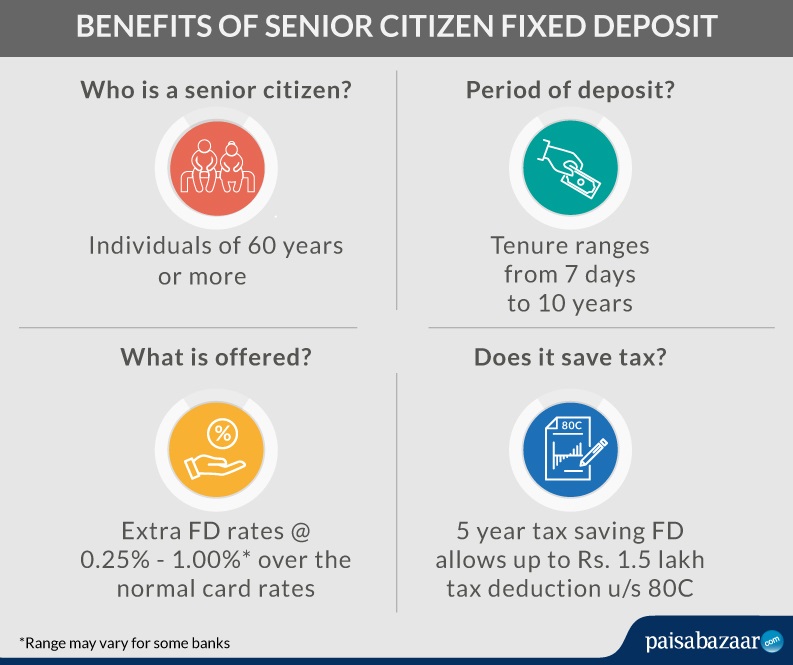

Bank of Baroda offers several fixed deposit schemes to choose from, depending on your chosen preferred term period (short-term or long-term). This range of choices makes fixed deposits a convenient option for a range of investors, from salaried employees to self-employed professionals to senior citizens.

As low-risk instruments, fixed deposit investments offer both, security and competitive interest rates on your principal amount.

For Present rate offered, please visit our Interest rate page.

Most Important Terms & Conditions:

Eligibility

All Individuals and Non-individuals

Amount of Deposit

- Minimum

- SCR 1000.00 and in multiples of SCR 100/-

- Maximum

- No upper limit

Tenure of Deposit

Minimum : 6 Months

Maximum : 120 Months

Rate of interest

As per the maturity period of the deposit

Payment of Interest

Interest will be paid half-yearly.

Premature Closure

Premature closure charges would apply as per Bank’s guidelines if the deposit is withdrawn before the maturity date.

Availability of Loan/ Overdraft

Overdraft / Loan against deposit provided on demand upto 90 % of the outstanding balance in the account as on date of loan. Interest will be charged as per Bank’s extant guidelines from time to time

Others

Accepted as security by Government departments

Accepted as margin for non-fund based activities

- Withholding Tax: Withholding Tax will be deducted as per Seychelles Revenue Commission guidelines.

- Overdue Deposit: If renewal request is received after date of maturity, such overdue deposits will be renewed with effect from date of maturity at interest rate applicable as on due date provided such request is received within 14 days of maturity of deposit, after which interest for overdue period will be paid at the rate decided by Bank from time to time.

- Advance against Deposits: This facility is not available to Minor account in single name . If the interest is not deposited for more than 2 quarters, term deposit will be apportioned immediately.

- Interest Certificate available at request of customer

- Deposit Certificate – Term Deposit Receipt is provided

- Mode of Payment: Maturity proceeds are credited SB/ CA account of the customer. In cases where there are no operative accounts of the customer, maturity proceeds can be given in cash below SCR 20,000 above which DD/ Pay Order will be issued.

Bulk Deposits (More than SCR 1 Million)

- Bulk deposits can be opened under any of the above mentioned schemes under retail time deposits.

- Bank reserves the right to accept the deposits above SCR 10 Million.

- Rate of interest for Bulk deposits is different from retail time deposits.For interest rate on bulk deposit, please contact the branch.

- Bank reserves the right to accept request for premature payment as the same is agreed at the time of account opening by the customer. On acceptance of premature payment request, the penal clause will be same as in schemes under retail time deposits.

You can see below links also

- Current Interest Rates

- Fees and Charges

- Minimum

Bob Interest Rate

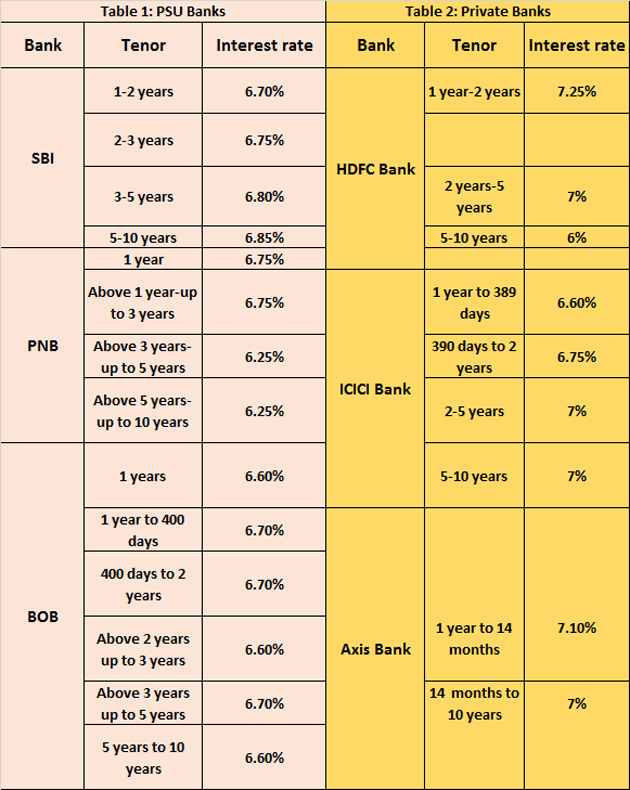

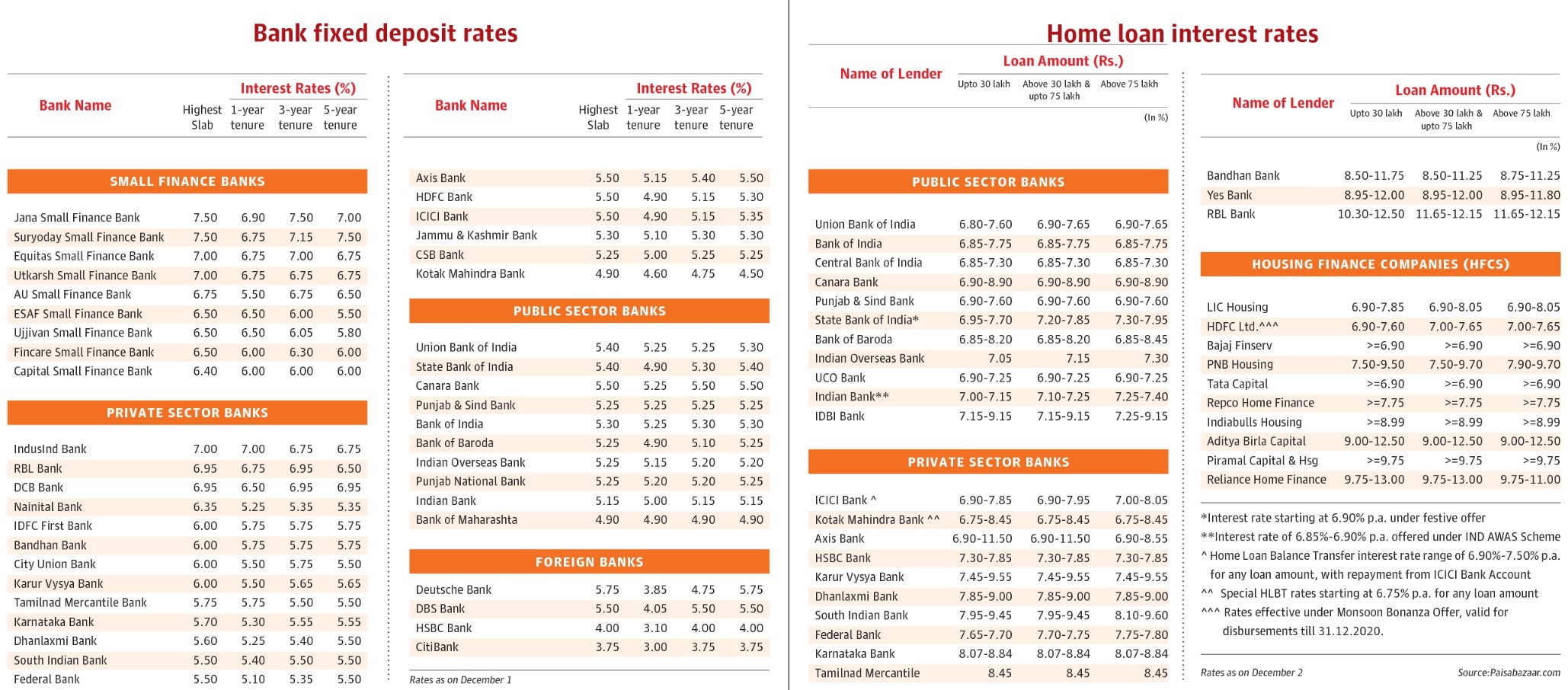

The current interest rate offered by Bank of Baroda ranges between 4.50%-6.25%. For senior citizens, the ICICI FD interest rates range between 5.00%-6.75%. The interest rates for below 1 crore and above 1 crore on fixed deposit depend on which category you fall under and your choice between different banks. Bank Of Baroda offers NRO Fixed deposit interest rates to NRI customers from 1 year to 5 plus years. Find Bank Of Baroda FD interest for NRO customer from below list.

Services

IN THIS ARTICLE

To make banking flexible and convenient as per the requirements, Bank of Barodaprovides different types of accounts – current, savings and the salary account. Each of these accounts serves different purposes and are for the benefits of a different group of customers.

Bank of Baroda Accounts

There are different type of savings account – Baroda Centenary savings account, savings bank account, super savings account, Baroda basic savings Ac, Baroda Bachat Mitra, Baroda Pensioners Savings Bank account, Baroda Jeevan Suraksha Savings Bank Account.You can also check here Bank Accounts with great benefits like Andhra Bank Accounts and ICICI Bank Accounts.

The Baroda Centenary Savings account provides a wide variety of features such as the Auto sweep which transfers the additional funds into a term deposit, auto reverse sweep which transfers funds back to the savings account from the term deposit so as to clear a cheque in conditions of insufficient funds, collection of outstation cheques without paying a fee, free debit card, provision of instant credit for outstation cheques valued Rs.25,000, and the interest on the funds is paid quarterly.

You Can Also Check For Better Banking Experience

The savings bank account is the simplest of all and is very easy to operate without any fees. This account is provided for employees of central and state government organizations, public and private limited companies, agents of life and general insurance companies, and students. The minimum balance in the account can be zero and the account still remains working. The deposits that are linked to this account are provided with insurance from DICGC. If you are looking for loans at low interest rates then Bank of Baroda Loansare best for your needs.

The super savings account is provided for customers in metro and urban regions. The features associated with the account are the auto sweep, reverse auto sweep, the issue of demand draft without any charges, and free collection of outstation cheques.

The Baroda basic savings account is for the general public especially those with low to middle-income levels. Housewives, employees working in unorganized sectors, students, and all others with low income and wish to save the money in a bank account are eligible to open the account. The account is not for trusts, societies, and non-resident Indians. The minimum balance in the account can be zero and there is no maximum limit. Other features available for the savings bank account holders are a free debit card, net banking facility, 50 cheque leaves for free per year, and the flexibility to provide standing instructions for automatic deduction of monthly payments.

The Baroda pensioners savings bank is for senior citizens. The account can be opened with a deposit of just Rs.5. The features available with the account are the auto seep out, overdraft facility, the instant credit of outstation cheques valued Rs.25000, free debit cards, internet banking, and unlimited chequebooks. If you are interested to know about other bank accounts features also then here are some banks with best features City Bank Accounts, Dena Bank Accounts and Karnataka Bank Accounts etc.

Bank of Baroda Salary advantage savings account is the unique salary account with additional benefits. The account comes with an inbuilt overdraft feature of up to Rs.1 lakh. The account can be opened by individuals aged 21 and above and working in Central or state government organizations, Semi-government organizations, PSU, urban development authorities, universities, MNC’s Urban development authorities, Universities, and reputed public limited companies. The minimum take home salary should be Rs.5000. Other features available for the account holders are the free cheque books and no limit on the minimum and maximum account balances.

The Baroda Jeevan Suraksha Savings Bank account is open for individuals in the age group of 18 to 60 years. The account holders are provided with an insurance coverage worth Rs. 5 lakhs from India First Life Insurance Co Ltd. At the time of opening the account, the customer should pay the insurance premium and submit the health declaration form. The minimum account balance should be Rs.1000. Other features available are 20 cheque leaves free for every six months, auto sweep and auto reverse sweep. A penalty of Rs.100 has to be paid for not maintaining the minimum account balance.

To open an account with BOB, the applicant should provide the documents related to IT declaration, proof of residence, passport size photo, and also an introduction according to the rules of the bank. If you have any quires regarding Bank of Baroda accounts then you can contact Bank of Baroda Customer Care help at any time.

Bank of Baroda Deposits

Bank Of Baroda Fixed Deposit Interest Rate October 2020

Bank of Baroda provides simple deposit plans that fit the needs and income levels of different groups of BOB Account holders. From the available multiple options, customers can choose the tenure, type of deposit and the withdrawal instructions for the deposit. The interest rates are also very good multiplying your earnings. The deposit holders are also provided with interesting features such as safe deposit lockers, overdraft facility, and the outstation cheque collections facility. The three different types of deposits are Fixed, Savings, and Current deposit plans. You can withdraw your money with the help of Bank of Baroda Debit Cards with out visiting the bank.

Bank of Baroda provides three different categories of fixed deposit depending on the tenure for which the deposit is being made. The three different categories of deposits are deposits up to 12 months, deposits over 12 months, and recurring deposits.

You Can Also Check Here For Better Features Of Bank of Baroda

The two deposits under the first category are Baroda Holiday Saving Recurring Deposits and short deposits. The Baroda Holiday Saving Recurring deposits help the customers plan their holidays in the next year at the price that is available today. The deposit is being offered in association with Thomas Cook India (Ltd). At the time of opening the deposit, the customer is given the option to choose the travel package. The cost of the holiday package is divided into 13 equal parts of which 12 are to be contributed by the customer as monthly installments. The 13th payment is provided by the TCIL in the form of interest earned on the amount paid during the 12 month period. The short deposits included in the category – deposits below 12 month period are perfect for those preferring to save for a short period of less than one year. The features of the deposit are the availability of overdraft facility of about 95% of the deposit amount. The overdraft facility can be availed by the customer without paying a processing form, documentation or the guarantor. The overdraft amount can be for a short period of one day or for a long period up to the date of maturity of the deposit. The interest to be paid for the amount taken as overdraft is 1.5% percent.Other Banks like HDFC Bank Deposits,IndusInd Bank Deposits and Union Bank Of India Deposits also providing different type of Deposits same as the Bank of Baroda.

The different types of term deposits over one year are Baroda advantage fixed deposit, Baroda Utsav Deposit Scheme, fast access deposit, BoB Suvidha Fixed deposit scheme, Regular income cum recurring deposit, and the term deposit – Yatha Shakthi Jama Yojana. The interest rate for the Baroda advantage fixed deposit is slightly higher than that of normal deposit. However, the minimum deposit amount is about 15,01,000 and the maximum deposit amount is 10 crores.

The fast access deposit provides an overdrawing facility of about 95% of the deposit value. The deposit tenure ranges from a minimum of 12 months to a maximum of 120 months.

The BOB Suvidha Fixed Deposit Schemeis for those who wish for flexible withdrawal of the funds from fixed deposit without paying a penalty.

Nre Fd Rate

Bank of Baroda Interest Rates

The interest rates for short-term deposits vary from 4.50% to 6.9% depending on the tenure. For tenure ranging from 1 year to less than two years, the interest rate is high of about 6.9%. The interest rate is on par with the interest offered by banks like SBI on the term deposits. The interest rate calculated on the fast access deposit is 1% less than the normal rate if the deposit is withdrawn before the maturity date. Senior citizens are given an extra 0.5% interest on all the deposits. For term deposits valued Rs.15 lakhs to one crore, the interest rate is 7.00%. The interest rate available for savings account range from 4.50% to 6.90% depending on the period for which the funds are maintained in the account. South Indian Bank Deposits and Axis Bank Deposits are also providing the best interest rates for different deposit schemes depends on the period of deposit.